Vanguard - Reimagine Onboarding

Vanguard - Reimagine Onboarding - Tamara Macdonald - UX Leader

ROLE: UX Director + Senior UX Strategist for CORE JOURNIES

From 2018 - 2021, I was Senior UX Director/Strategist for Vanguard’s Self-Directed Onboarding experiences. I lead 4 design teams who serviced 12 scrum teams through 5 product roadmaps. I also effectively managed a 9-month pivot, re-designing our fraud mitigation methods which resulted in the ‘Prospect Verification + Registration’ product.

THe Challenge

In the midst of a substantial modernization initiative, Vanguard is transitioning operational systems from legacy on-prem platforms to cloud-based applications. With over 2,500 new accounts opened daily, onboarding processes are the life-blood of the enterprise. Originally, we were asked to deliver a best-in-class onboarding experience, integrating it with a new Design system. However half-way through our efforts, we faced challenges with fraud attacks, prompting a swift focus on Adaptive Authentication for enhanced security. Adding to the complexity, we were tasked with integrating two new products: the Cash product and Vanguard's inaugural robo advisor, Digital Advisor. This dual priority underscored our commitment to fortifying security measures while expanding our product offerings and improving the overall investor experience.

The Approach

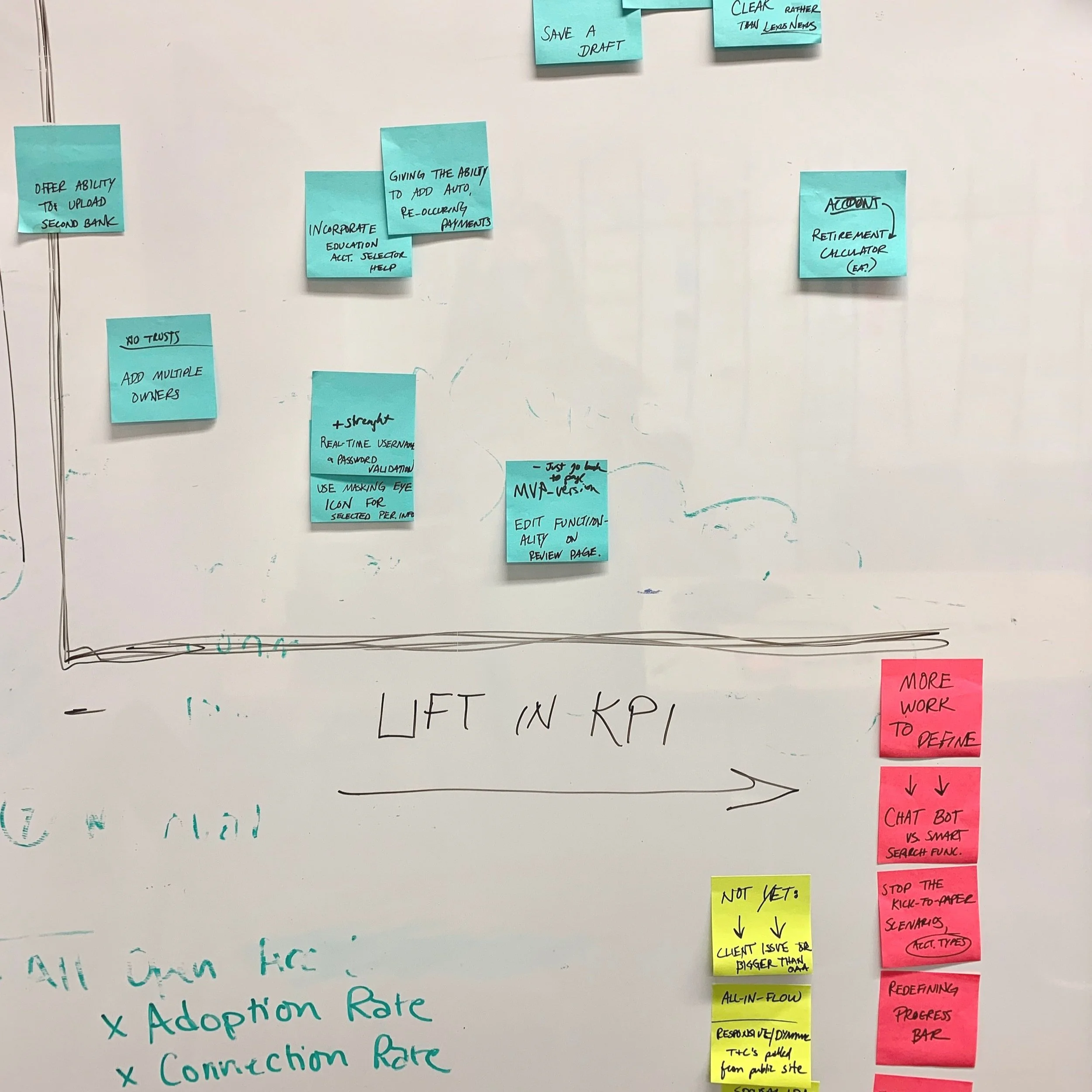

Strategic Shift and Team Restructuring: We needed to transitioning from a sole focus on 'Re-envisioning Onboarding,' to a dual purpose of modernizing AND 'Stop Fraudsters Now' into both current and future experiences. This necessitated the realignment of objectives with business OKRs, obtaining support from senior leaders, and establishing new cross-functional teams—BAU CX, Fraud CX Team, and Enhancement/Wild Card UX Team—each with defined roles and responsibilities. As always, we embraced agile methodologies for flexible project planning, simultaneous enhancements such as the Account Selection Tool and the integration of two new products, the Cash Plus Account and Vanguard's inaugural robo-advisor, Digital Advisor (DA).

Rapid Skill Development + New Features + Strong Communication: To address the new challenge, swift upskilling on cutting-edge Adaptive Authentication experiences and building Identity UI modules for the Design System were essential. Coordination with operational teams around Cash and DA turned into daily touchpoints. Strong communication channels were essential and kept key stakeholders informed about progress, challenges, and evolving priorities. Through all this, we also delivered the Account Selection Tool which increased click-through rate on Onbaording ‘s most notorious page by 22% >> Confidently selecting the right account type is one of the top client friction points.

Continuous Evaluation and Celebration of Success: Regular evaluations against success metrics guided continuous adjustments, considering changing priorities and resource constraints. Celebrating key milestones became integral, fostering team morale. A major celebration marked the successful conclusion of the 'Fraud Era,' enabling a return to our originally planned roadmaps, now enriched with UI ‘delighters’, the successful integration of the new Cash Deposit Account and Digital Advisor.

KEY RESULTS:

11% increase in journey completion rate

1.5M yearly operational savings from fraud mitigation efforts

22% increase in click-through rate

ABout Vanguard

Vanguard is a global investment company with over $7 trillion in assets under management. It revolutionized low cost investing for the masses and is the second-largest provider of exchange-traded funds (ETFs) in the world. In addition to funds, Vanguard offers brokerage services, investment education, financial planning and asset management.